The Vortex Indicator is an oscillator which is applied to identify the start of a new trend and to approve a current trend, its strength and direction. The indicator is a combination of two lines which capture positive and negative trend movements: the uptrend line (VI+) and the downtrend line (VI-).

The idea behind the vortex pattern is that it connects the highest and lowest points of the market’s price candles or bars. The principle of the Vortex indicator is pretty simple — the greater the distance between the low of the ongoing bar and the high of the following bar, the greater the positive movement. Likewise, the greater the distance between the high of the current bar and the low of the next bar , the greater the downward movement is.

The indicator may be used with all assets, on all time frames by both professional traders and beginners.

The origins

The Vortex indicator was created by Etienne Botes and Douglas Siepman, who, in turn, were inspired by the work of Viktor Schauberger, who was an Austrian inventor. His ideas and discoveries was based on the events which he observed in nature. He studied the flow of water, and, using the idea, the creators of the indicator supposed that the movements within financial markets are similar to the vortex motions in the flow of water. Besides that, the idea of directional movement was considered, adding true range into the calculation of the indicator.

How to set up

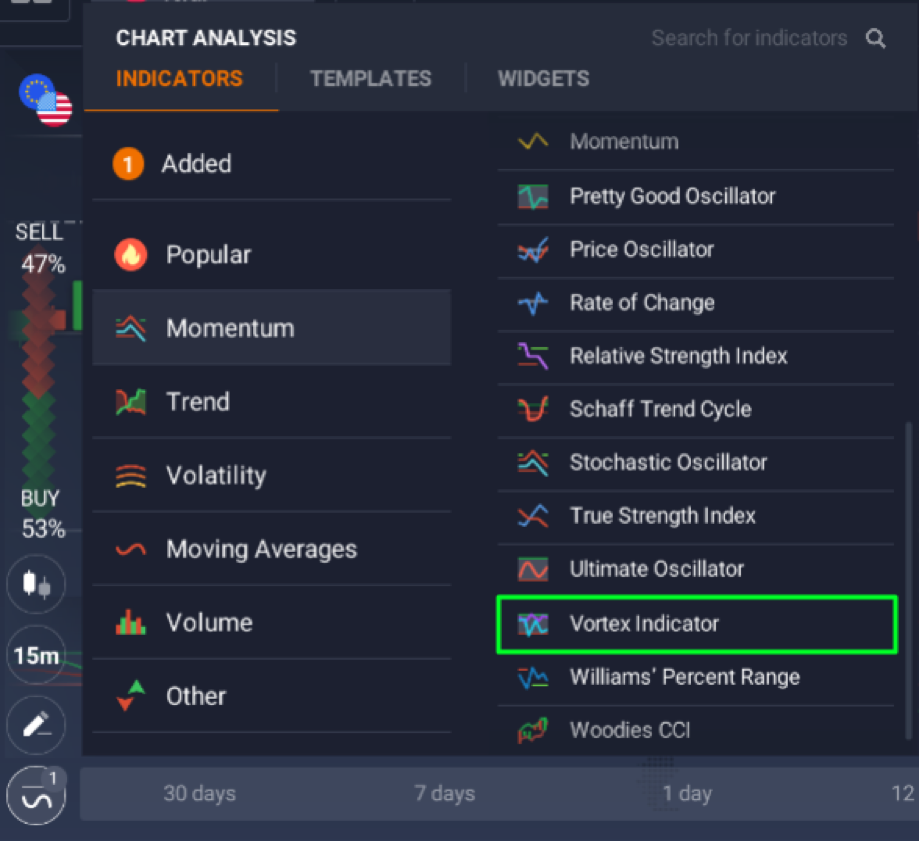

The Vortex indicator is from momentum indicators category and it may be found in the “Momentum” tab of the indicators menu.

By default, the period for the main lines is equal to 14, the overbought line is set at 1.1 and the oversold line at 0.9. You may keep the standard parameters or change them in accordance with your preferences and trading style.

How to trade

After you have set up Vortex, you need to learn how to read its signals. Here is how to do so.

By default, the positive trend line is blue and the negative trend line is purple. Generally, the line which is on top indicates the predominant trend (a positive trend or a negative trend). It is crucial to consider the crossing points of the two lines and also their position in relation to the overbought and oversold levels.

BUY signal is received when VI+ line is lower than the VI- line, crosses above it and remains on top. SELL signal is received when VI- line is lower than the VI+ line, crosses above VI+ and remains on top. Moreover, not all signals you receive have to instantly translate into an open position. Rather, it is a signal for you to pay close attention to the market, analyze the performance of the underlying asset and think about opening a trade in the needed direction.

On the picture higher you may see the Vortex indicator being used on the EUR\USD graph. In this certain case, the intersections surely demonstrate the shift in the trend direction. The distance between the lines mirrors the strength of the trend.

Using Vortex indicator with other indicators may help avoid false entry signals. ADX or MACD will work perfectly. When you create your own trading system, avoid using two indicators of the same kind together, because their signals may come from the same source, lowering their forecasting power. Trend-following indicators may work fine with Vortex. It may as well be useful to apply stop-loss and take-profit levels when you trade with Vortex in order to better control the risks because regardless of how good the strategy is, they all cannot give precise signals all the time.

Leave a Reply