Balance of Power (BOP) is a technical analysis indicator which estimates the market power of buyers and sellers at any specific moment. It may help you identify the general market sentiment. Due to this indicator you can:

1. Better determine the general trend,

2.Identify entry and exit points,

3.Identify overbought and oversold positions.

Balance of Power may be applied on any time frame and for any asset category, including Forex, indices, ETFs and stocks. In this article we will explain how this indicator works. You can use BOP as a secondary tool, which can help you make reasonable trading decisions.

How does it work?

BOP might look similar to your average oscillator, but it is not! It does not reflect the performance of the asset with upward and downward fluctuations. It follows the logic of its own.

BOP is calculated according to this formula:

Balance of Power = (Close price – Open price) / (High price – Low price)

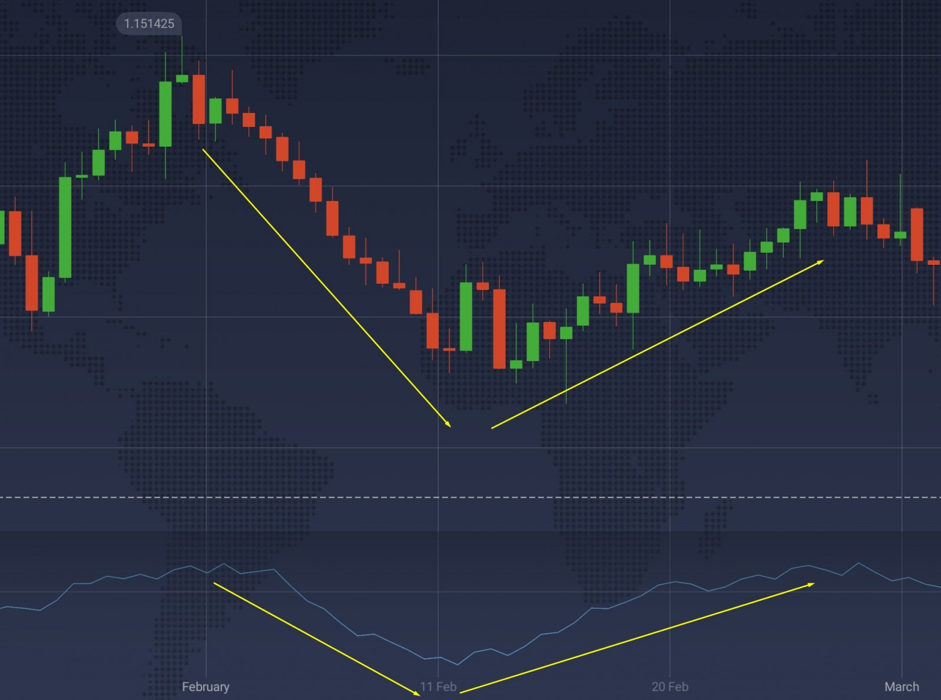

If the indicator is higher than the zero line, it indicates the predominance of positive market trend. If the indicator is lower than the said line, sellers have advantage (in accordance with the indicator). That’s the most crucial fundamental of the BOP. Overall, it is an interesting version of the indicator that tracks prevailing market conditions in real time.

How to use Balance of power in trading

You may already know that overbought and oversold levels are used in order to identify those moments which have a higher probability of a trend change. Actually, no asset is able to rise forever. What has increased has to move back down, so is the market law. By determining overbought/oversold positions you will determine periods when the trend change is the most possible and, therefore, getting an advantage in trading.

However, it is worth remembering that the information provided by this indicator is not enough to use on its own. Buying and selling pressure, though helpful, is not directly connected to the trend. Buyers can have an upper hand (according to BOP) and the asset will still lose in price. The opposite can also be true: sellers can have an upper hand (according to BOP), and the asset will still appreciate. Use this indicator carefully and combine it with other technical analysis tools: oscillators, trend-following and momentum indicators.

One of the issues which you may deal with when you use the Balance of Power is its movement patterns. Actually, it may be difficult to identify if the indicator follows the trend or not. A number of traders think that a BUY opportunity appears, when Balance of Power has an intersection with the zero line from below.Vice versa, if the indicator has an intersection with the zero line from above, a SELL position can be set up. But this may be not true sometimes as well. Because of its specific nature, BOP may be higher or lower than the zero line independently of the dominant trend.

BOP may confirm other indicators signals as well. When another technical analysis indicator indicates an upcoming trading opportunity, you can apply Balance of Power in order to identify what other market members think about the price of the asset, and if it has to rise or fall. If you use independent indicators to confirm each other’s signals, it may be simpler to get an objective technical summary.

How to set up the Balance of power?

It is pretty simple to set up the Balance of Power indicator:

- Click on the “Indicators” button which is located in the bottom left corner of the screen

- Go to the ‘Momentum’ tab

- Pick the Balance of Power from the list of available options

- Don’t change the settings and click “Apply”

You may also set the amount of periods and the moving average type. Note, if the amount of indicators is higher, the indicator will become less sensitive. Conversely, if the amount of indicators is lower, the BOP will be more sensitive, but the amount of false alarms will also rise. The moving average category may also have an effect on the readings of the indicator.

Now you can use the indicator!

Leave a Reply