What is IqOption Detrended Price Oscillator (DPO) ?

The Detrended Price Oscillator (DPO) is a technical analysis tool that was created in order to remove the influence of the general trend from the price action and make it simpler to determine cycles. The DPO is a momentum indicator, but it is not similar to MACD. The DPO is used to determine high and low points within the cycle and also to evaluate its length. In this article we will explain how to use the DPO in trading.

What is the DPO?

Generally speaking, the Detrended Price Oscillator is used to remove the influence of a long-term trend on the current prices. You may ask, why trader would do that if he is supposed to follow the trend. Well, sometimes it is easier to evaluate the durability of a trend and predict a forthcoming reversal when trend-related price movements are fully removed from the graph.

In the end you will get a curve which shape is really very much alike the actual price chart. The most distinct difference between them is the lack of the main trend on the DPO. It is essential to understand that DPO is based on the use of a moving average which is biased some periods to the left in order to use the DSO indicator in a right way. The Detrended Price Oscillator will compare past prices with a moving average.

How to set up?

It is pretty simple to set up the DPO indicator.

- Click on the ‘Indicators’ button in the left bottom corner of the trade room and go to the ‘Momentum’ tab

- Choose the ‘Detrended Price Oscillator’ from the list of available options.

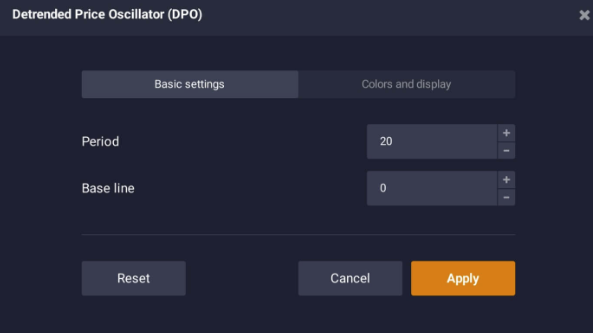

- Don’t change the default settings and click the ‘Apply’ button. Or you can set the period and the baseline, in order to make the indicator more sensitive or to decrease the number of false alarms.

Now you can use the DPO indicator!

How to use in trading?

As we already mentioned above, the DPO determines the difference between the past price and the moving average. The horizontal line correlate to the offset moving average. Consequently, the DPO is positive when the price is above and negative when below the average .

The indicator is specifically helpful when you trade on shorter time frames. So because you are not interested in long-term trading, you may want to expel long-term trends from your evaluates and only deal with shorter fluctuations. In this case Detrended Price Oscillator can be an excellent tool. Before you open a trade, take a brief look at the DPO and you will know to what extent the current trend is in charge for the price change.

Furthermore, the DPO may be applied in order to evaluate the average cycle length. For instance, if you trade CFDs on a certain stock, you may want to know the amount of time it takes for the price to increase and then decrease. Financial markets have a tendency to repeat themselves. Thus, growth periods will mix with depression periods. Because you use the Detrended Price Oscillator, you are can be ready for an upcoming trend reversal.

Calculate the distance between the nearby maximums and minimums to evaluate the average cycle length. Try using it later when the current cycle is close to an end.

It is better to use the DPO indicator as a secondary tool and it can be used together with a trend following indicator such as MA or Alligator, ATR or MACD. Keep in mind that the DPO and other indicators can sometimes give false signals.

Leave a Reply