Parabolic SAR on IqOption is a technical analysis indicator created by Welles J. Wilder. It was first mentioned in Wilder’s book “New Concepts in Technical Trading Systems” in 1978. SAR means “stop and reverse”, it tracks the price action over time. The indicator is placed lower than the price when the prices increase, and higher than the price when the prices decrease. Wilder called this indicator the “Parabolic Time/Price System.”

The indicator was created with the purpose of informing the trader about probable trend changes. Although Parabolic SAR is a one of a kind indicator with high practical potential, it have to be used together with other indicators in order to reach the maximum accuracy.

How does Parabolic SAR work?

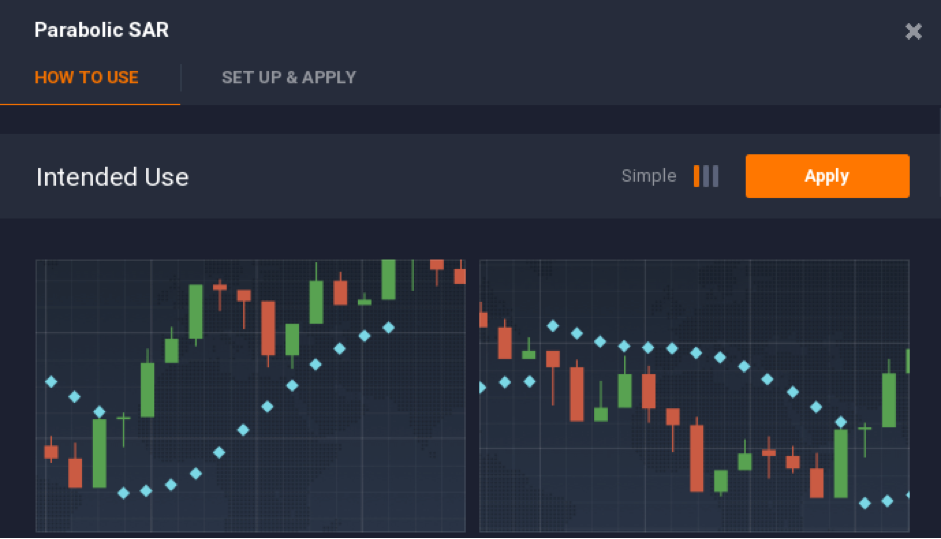

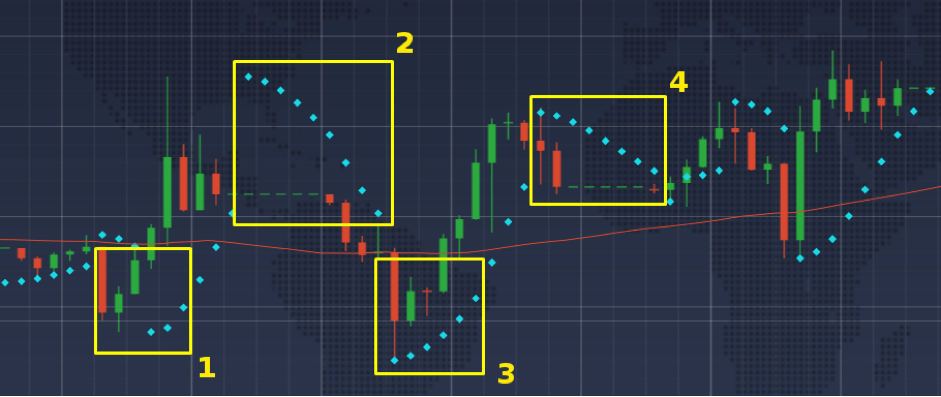

The concept of the indicator is pretty simple. If the price has an intersection with one of Parabolic SAR dots, the indicator is awaited to reverse and occur on the opposite side of the price line. Suchlike behavior may be an indication of a forthcoming trend reversal or at least a trend slowdown.

It may be seen in the picture above that if Parabolic SAR touches the price, the trend has a reversal. This risk-following indicator may be applied in order to evaluate the best entry/exit points, forecast the trend direction and predict behavior of the price action in the future.

Settings for intraday trading

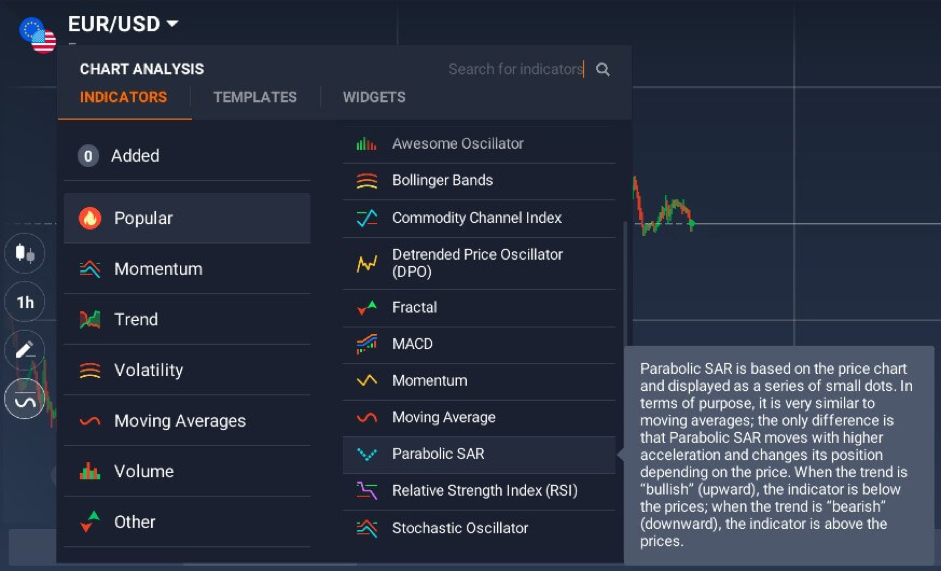

For the purpose of applying Parabolic SAR technical analysis indicator, follow these steps:

1. Click on the “Indicators” button in the bottom left corner of the trade room

2. Go to the “Popular” tab

3. Select Parabolic SAR from the list of available options

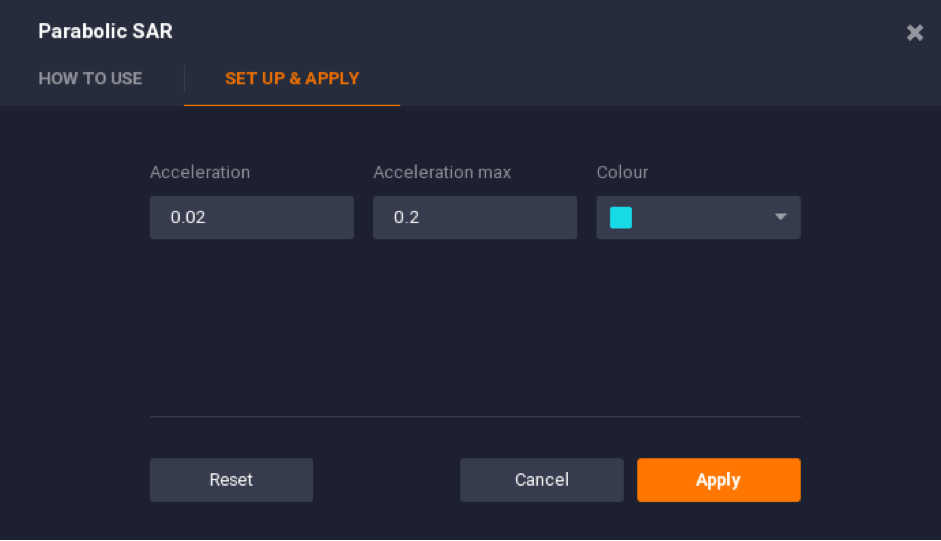

4. Click “Apply” if you want to use the indicator with default settings.

5. Or switch to the “Set Up & Apply” tab and adjust the indicator in accordance with your preferences.

Traders may configure two technical settings in the “Set Up & Apply” tab and these are acceleration and acceleration max. If you increase the numbers, you are able to make the indicator more sensitive, but at the same time you will lower its accuracy.

The opposite effect may be achieved by decreasing the values of acceleration and acceleration max: the indicator will turn to be less sensitive but will as well give less false signals. It is highly important to find the correct balance between accuracy and sensitivity, if you are interested in applying Parabolic SAR in intraday trading.

How to use Parabolic SAR

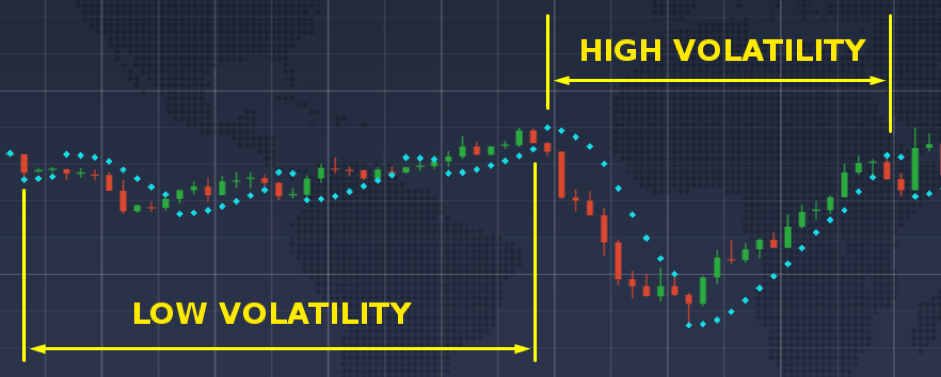

In accordance with Welles J. Wilder, the indicator have to be applied only throughout powerful trends, which commonly don’t exceed 30% of the time. The application of Parabolic SAR on short time periods and throughout the sideways movement is not recommended because the indicator loses its forecasting power and may return false signals.

Experienced traders regularly use Parabolic SAR together with other indicators. One of the probable combinations — Parabolic SAR and Simple Moving Average — and its practical uses are explained below. It is recommended to double-check Parabolic SAR signals applying other indicators.

Parabolic SAR + SMA

The combination of these two technical analysis instruments is famous among professional traders. Parabolic SAR (acceleration = 0.04, acceleration max = 0.4) and the SMA (period = 55) are applied together to approve each other’s signals. If you use both indicators simultaneously, you may expect for the following signals to occur:

Predicting bullish trend

If the price is lower than the SMA and Parabolic SAR shows positive movement, the trend may be awaited to turn into bullish.

Predicting the bearish trend

If the price is higher than the SMA and Parabolic SAR shows negative movement, the trend may be awaited to turn into bearish.

Also note that any indicator is not able to guarantee precise signals all the time. Sometimes all indicators will give false signals, and Parabolic SAR too. You, as a trader, have to separate true signals from false ones on your own.

Leave a Reply