What do you think is considered to be a successful trading? A lot of traders believe that success in trading is all about looking for a perfect trading opportunity and speculate on it. However, the consistency is a key to successful trading. You most likely already know that in order to trade, the trader has to obey specific rules. Risk management is also a set of the stated rules. Perhaps, the most essential of all, as those who want to earn money should first learn how to manage their losses in a correct way.

Every novice trader should understand and know how to apply risk management since it is a major concept in trading. Nevertheless, people betray little value to this topic and sometimes even consider it as not important. Not only one trader had lost all his funds because of his lack of discipline and insufficient risk management.

If you expect one trade which will change your life for the better you act as a gambler (which is clearly not effective). But being honest, trading has nothing to do with gambling. You have to understand that as soon as possible. You shouldn’t rely on a blind luck when you trade. Risk management rules are here for you to help and make your trading more beneficial.

IqOption The 2% rule

If you invest a random amount of funds into a deal just because you think it is a nice idea, you behave like a gambler. On the other hand, placing a specific calculated amount can pay off in the long-term. It is commonly accepted that the best amount of money you have to invest in a single deal shouldn’t be more than 2% of your whole capital.

In order to have a successful trading, it is crucial that you know how to control losses, spot a trend reversal, open a deal in the right direction etc.

It does not matter which trading strategy you use, from time to time you will have to deal with losses. In this case, risk management rules are extremely crucial. When you win one trade after another, it is not important if you have 1% or 50% of your capital invested. Basically, it would be better if you place as much as possible when success is guaranteed. Nonetheless, you always have a chance to fail with your predictions and this chance is really high.

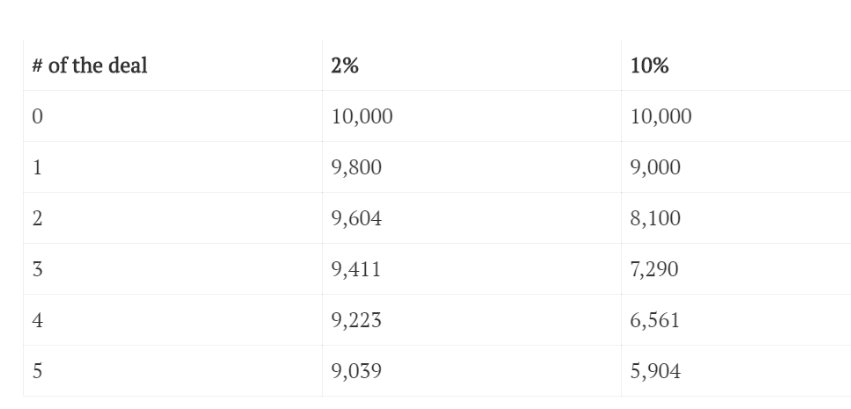

Consequently, you might want to search for the balance between the potential profit and loss that will probably arise. A number of traders agree for 2% of their trading capital per one trade. According to these traders, 2% is the perfect choice for consistent trading, as well it provides enough flexibility to get through the losses period that will arise at some point. In order to better understand this logic, we will give an example. For instance, let’s take a look at a losing streak of only 5 trades and analyze what happens when designating 2% and 10% of the trading capital to a single trade.

As you can see in this example, there is a large difference between 2% and 10%. When allocating 2% of the capital to a single trade loses may come to only 10% of the initial capital. With 10% at stake in every trade, loses may be more than 40% after a series of only 5 not successful trades. It is a big difference! It does not matter how good you are at your best, at your worst you want to stay as humble and disciplined as it is possible.

You should understand that as a trader, you are not looking for a jackpot. Instead, you have to be interested in a series of small wins, each of them will keep bringing you closer to your aim.

Fund placing is not the only risk management rule to follow.

However, it is something that you need get along with and obviously implement it in your daily trading. If you will follow this simple rule, you will be able to significantly increase your chances of progress.

Leave a Reply