Highest High and Lowest Low are two technical analysis indicators which demonstrate the highest and the lowest asset price on the price chart as two lines.

If you use these two indicators together, you may have a quite strong trading system.

You can you these tools individually or you can use them as a supplementing tool, which approves or declines the signals received from various indicators. They may also show the potential reversal points, that help you evaluate the probability of a trend change and the probability of a sudden price move.

The concept of these indicators is not only very much alike but as well is really simple. Highest High shows the highest price noticed during a number of periods. Lowest Low indicates the lowest price noticed during several periods. You may set the amount of periods when you set up the indicator. The longer the period, the longer the last observed lowest/highest price will rule the chart. This works the same with both indicators.

How to use it in trading on IqOption?

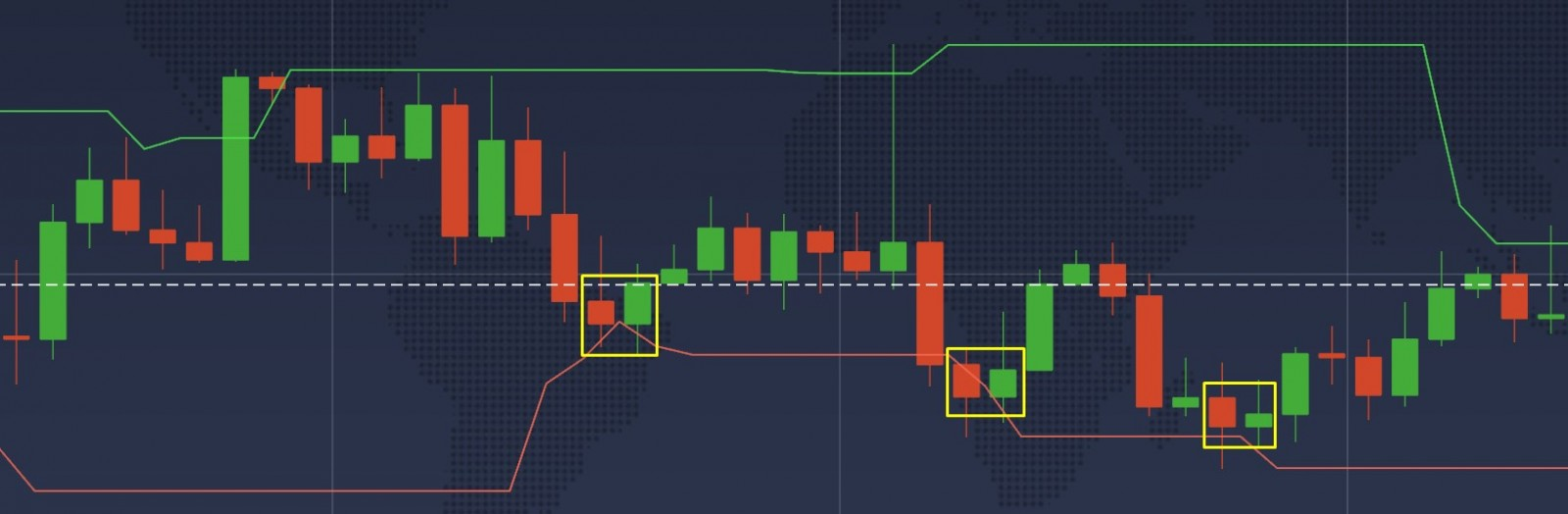

So how can you use Highest High and Lowest Low in your trading. Highest High and Lowest Low indicators may be used in order to work with a dynamic price channel. A price channel is a corridor inside which the price of the asset will move, while the ongoing trend is dominant. If there is a trend reversal, the price channel will follow. Commonly, the price channel is limited by 2 parallel lines. Several indicators, like this one, are able to make their own price channels.

There is another way, how you can apply the indicator. If the price moves only in the price channel, the trader would expect for a trading opportunity to appear. Yet, if the price goes away from the channel, then there are two possible outcome, either the price will keep going in the same direction and setting new maximums and minimums or the price will rebound and go back to the channel. However, it may be difficult to understand what the outcome will be if the price will reach either Highest High or Lowest Low. You will need to learn to identify the difference between a rebound and a breakthrough because it may make or break many trades.

Several traders may await for the rebound and decide to open a buy position, if the price action has an intersection with the lower line, which is red line and decide to open a sell position, if the price action has an intersection with the higher line, which is a green line. If traders await for a breakthrough and a powerful trend to continue, they may decide to open a buy position, if the price action has an intersection with the higher line, a green line and they may decide to open a sell position, if the price action has an intersection with the lower line, a red line.

Consequently, It is really important to distinguish between a rebound and a breakthrough. Moreover, an approval can help you a lot. When determining a candle which closes on of 2 lines, you may decide to wait for 2 more candles to close for the purpose of receiving an approval. It can be much simpler to evaluate the future movement if you analyze these 2 candles.

As it was mentioned above, you can as well use Highest High and Lowest Low together with other technical analysis instruments. It doesn’t matter what you are using, you need to find something that works well with these indicators, and these can be MACD, ADX and Trading Volume, all of them would work well, also better use indicators that are not illustrated on the price chart directly, because it may be hard to perceive all the information. You can think about opening the trade when all indicators show the same result.

Moreover, note that Highest High and Lowest Low, just as any other indicators, are not able to give correct signals all the time, from time to time they may give false signals. Thus, you have to double check the signals sent by these indicators, using other indicators.

How to set up?

Here is how to set up Highest High and Lowest Low indicators:

1. Click the ‘Indicators’ button in the left bottom of the screen

2. In the ‘Other’ tab pick Lowest Low from the list of available indicators,

3. Do the same steps for the Highest High

Now you can use these indicators!

Now that you know how to set up and trade using Highest High and Lowest Low, you may go to the trading platform and try them yourself!

Leave a Reply