How to start trade Digital Option?

We explain how you can start trade digital option with IqOption broker in few simple steps, just watch video that explain you all necessary steps of digital options trading.

IqOption Digital Options. Introduction of a New Tool for Trading

Digital Option represents a new tool used for trading, which was created by IQ Option. It represents a combination of binary and classic options features. Digital option enables to perform trading of various instruments. The risks and profitability associated with every particular deal depend basically on a strike price that is selected manually – that is the major distinctive feature of digital option.

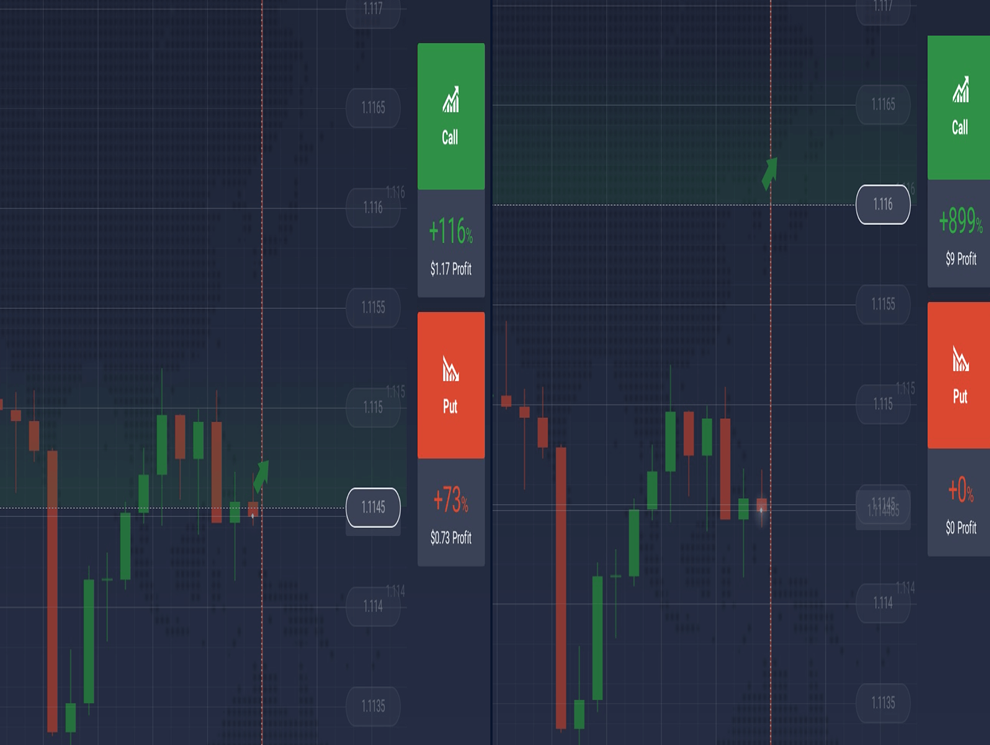

Digital Option price chart plotted in the IQ Option.

IqOption Breakdown of Digital Options in parts

Digital Options provide more flexibility and a better potential for earnings comparing to binary options, which have a predetermined profitability. Trader is free to alter the potential risk and profit amount via manipulations with the strike price. By bringing the strike price nearer to the current prices level, a trader basically decreases the potential profitability of that deal as well as limits the risk amount. However, a trader can also take extra risk by moving the strike price further away from the actual prices, while hoping to get a better profit.

Risks and profit potential are dependent on the distance between the strike and actual prices. Digital Option has also got the flexibility to be sold prior to the date of expiry. Once the trader sees that the trend starts moving in a wrong direction, he can directly sell the option anytime. The deal is possible to be concluded with several mouse clicks. Take a look at the steps to achieve that.

IqOption Digital Options Trading

In order to conclude a a deal the investor needs to follow these steps: Select the asset of interest; Select the money amount he is willing to invest; Select the strike price; Select “CALL” if he foresees that the price will rise, otherwise “PUT” if he expects the price to decrease. Wait until the expiration time otherwise sell the option earlier. Generally, there are two parameters only besides the type of asset that the trader needs to adjust while concluding a deal: money amount invested and the price of a strike. Regardless, the amount of available strategic options still remains high. Based on diversified factors, certain traders prefer not to select the strike price, which is too distant from the current level of the price, if they strongly believe that the price won’t reach the level that he desires. Other traders may consider a higher/lower strike prices, since they are prepared for extra risk while trying to get higher returns. Keep in mind that digital options expire only in-the-money when the actual price does not match the strike price. In case of call options, it is required to exceed the strike price by at minimum of one pip, while in case of put options it should be less than the strike price by a minimum of one pip.

Various strike prices are to be applied for strong and weak trends.

Introduction Video – digital options

Iqoption Risk Mitigation

The regulations of risk management are also applied to digital options deals. Certain traders follow the perception that that the allocation of more than 3% of a trader’s trading capital to one transaction only causes high risk and does not assist in a long-term trading. Hence, it is highly recommended to always take your time for learning and practicing various trading strategies as well as techniques via Practice account.

Leave a Reply