Stop-loss and take-profit (SL/TP) management is one of the most essential principles of Forex. Mastering of this concept and mechanics is crucial for FX trading.

Stop-loss is an order that you send to your Forex broker to close the position automatically. Take-profit lets you lock in profit when a particular price level was reached. Consequently, they are both used to exit the market. It is desirable , that they help you exit in the right way and at the right moment. There are some strategies because of which it is more difficult to make decisions but as well as they give the trader extra opportunities.

Opening stop-loss orders

So what is a stop-loss and why would you want use it in trading? When you open a stop-loss order. When you open a stop-loss order, you identify the exact amount of money you agree to risk in each specific trade.

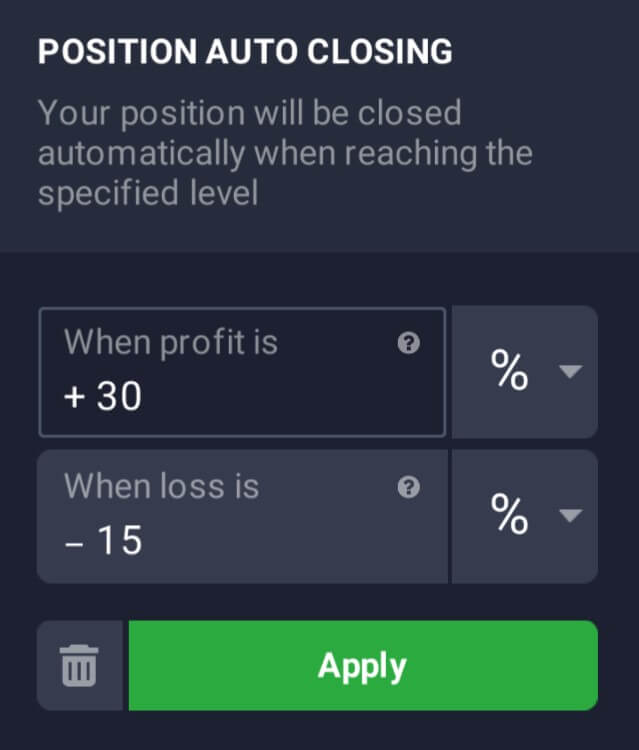

IQ Option trading platform calculates this certain amount in percents of your original investment.

At one point, every trader will have to learn how to cut off losses at the right moment, if they are willing to achieve a specific extent of success. Experienced traders think that it is a great idea to set stop-losses according to market conditions and not only according to the amount of money you are willing to risk. In this case, technical analysis, may play a big role too. Note that, most of the traders believe it is important to know when to exit out of the trade even before you open a position.

There are 3 main ways how to identify excellent stop-loss points:

- Percentage Stop. Identify the stop-loss position according to the amount of capital you are ready to risk at each specific moment. Stop-loss in this case will highly rely on your total capital and the amount of money that invested. Keep in mind that professionals suggest placing not more than 2% of your trading balance to each trade.

- Chart Stop. This approach most likely has to do with technical analysis than the others. Actually, resistance and support levels may as well help us identify excellent SL/TP points. One way how you can do that is you can set the stop-loss beyond either support or resistance levels. If the market is traded beyond these areas, there is a great opportunity that the trend will keep working against you. Then take what is left of your investment.

- Volatility Stop. Traders don’t have to miss the volatility. Volatility may be highly various with different assets and this can make a large effect on the results of trading. If you know for how much a specific currency pair may move, then it can help a lot in identifying excellent stop-loss points. Volatile assets can have a bigger risk and thus greater stop-loss levels.

It can be a great idea to create your own SL/TP system, which has different methods in it. Moreover, it have to be based on market conditions and your trading strategy.

When you use ST/LP, it doesn’t mean that you must wait until the chosen price level will be reached. You may, of course close the trade if the market shows a bad price action. However, you shouldn’t let your emotions decide for you, because in trading you should never rely on emotions and follow your strategy. So when you allocate a stop-loss order, you have to give your trading strategy enough time to do its work.

Stop-loss is not just the exit point, good stop-loss has to to become an “invalidation point” of your ongoing trading idea. Generally speaking, stop-loss have to confirm the particular strategy you are using doesn’t t work, but sometimes it might be a great idea to wait.

Opening take-profit orders

Stop-loss and take-profit work similarly but their levels are identified in another way. The purpose of top-loss signals is to lower the expenses of bad trades, in turn, the purpose of take-profit orders is to give an opportunity to take money at the peak of the trade. Setting excellent stop-loss signals and taking profit at the right time are both crucial. In addition, market always moves, it is not stable and what considered to be a bullish (positive) trend, may become a bearish (declining) trend in a few seconds. A number of traders believe that it is better to take appropriate payouts at the moment rather than wait and risk to lose all your potential payouts.

Keep in mind that if you don’t allow your payoff to increase quite high and close the trade before that, it not good as well, because this way you lose some part of your potential payoff. However, waiting too much can be bad as well.

The best case if you work with take-profit orders is to choose the right moment and close the trade right just before the trend is close to changing. Technical analysis instruments can help a lot in identifying the reversal points. There is a big variety of tools you may choose from Relative Strength Index, Average Directional Index or Bollinger Bands. These indicators are the best operating SL/TP.

Several traders may suggest using a 1:2 risk/reward ratio. In this case, if the amount of losses will be the same as the amount of wins, you will still have the opportunity to get the payouts in the long-term. Think about choosing the best risk/reward ratio, that will appropriate according to your personal strategy and note that there are no general rules which would work for every asset and every trader.

Things to remember to IqOption traders

Note that SL/TP is just another tool in your trading arsenal. Furthermore, you have to understand that trading skills are not only the right use of stop-losses and take-profit orders. In fact, you shouldn’t let any automated system to trade for you, better start controlling your emotions and trades. You will probably need a certain amount of time to master the use of SL/TP orders, but then you will master a necessary trading skill.

Leave a Reply