The Commodity Channel Index (CCI) is an oscillator-type technical analysis indicator. It is used to determine an emerging trend and to identify oversold and overbought levels. This indicator was originally introduced by Donald Lambert in Commodities magazine in 1980. Initially it was created to identify cycles in commodity trading, nowadays it is used to a lot of of assets.

The Commodity Channel Index compares the ongoing price of the asset with its average prices over a chosen period of time. If the ongoing prices are higher than the median level, the CCI is accordingly high. If ongoing prices are lower than the period’s average value, the CCI is accordingly low. Consequently, the CCI indicator enable to determine the overbought/oversold level.

The logic behind

The CCI estimates the difference between the ongoing price change and the average price change of the underlying asset. If the prices are higher than the average level, the indicator’s readings are likely to be high respectively. If the prices are lower than the average level, the readings are likely to be low.

The Commodity Channel can be used both as a primary and as a secondary indicator. If you use the CCI as a primary indicator, traders may want to track the overbought and oversold levels and also bullish and bearish divergences, to try to forecast coming trend shifts.

If you use the Commodity Channel Index as a secondary indicator, leaps that are higher than +100 can indicate a strong price action and an coming uptrend. Falls that are lower than -100 may indicate a weak price action and a likely downtrend.

How to set up CCI?

It is pretty easy to set up the CCI indicator in the IQ Option trading platform.

Click on the “Indicators” button in the bottom left corner of the screen, once you are in the trade room.

Go to the “Trend” tab and select “Commodity Channel Index” from the list of available options.

Then click the “Apply” button if you want to use the indicator with the default settings.

Moreover, You may as well set the Commodity Channel Index how you prefer the most. Keep in mind that if you use the CCI indicator with the default settings 70% to 80% of CCI readings would fall between +100 and -100. The shorter the look-back period the more volatile the CCI will be with a smaller percentage of values between +100 and -100.

How to use in trading?

New trend

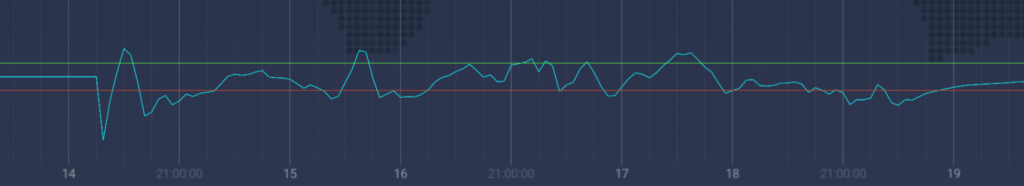

As it was stated before, 70 to 80% of all the CCI readings fall between -100/+100. If the readings leave the thresholds, it can mean that there is something interesting happening. If the indicator cross the +100 threshold from below, several traders would think that the bullish trend may occur. Because the Commodity Channel Index is a lagging indicator, the uptrend in fact could have already be gone. Trader on his own have to identify if it will last or not, and if yes, then for how long it will last.

If the -100 line is crossed from above, several traders would think that the bearish trend may occur.

Overbought/oversold

Commodity Channel Index is an unbound indicator, which makes determination of overbought and oversold levels a little bit difficult but not impossible. The main asset may remain decreasing its value long after CCI entered the oversold zone also increase even if CCI has been in the overbought position for enough time.

The choice of oversold or overbought levels are dependent from the market and the asset that is being examined. In the Forex market, it is commonly considered that the underlying asset is overbought if the Commodity Channel Index indicator is higher than the +200 mark, which is quite difficult to reach. Also, if CCI went down for more than -200, the asset is believed to be oversold.

Divergences

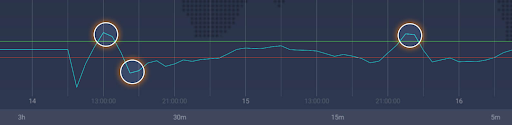

If directional impulse doesn’t approve the price, it may be considered that the trend will shift soon. If the Commodity Channel Index makes a higher minimum and the underlying asset makes a lower minimum, a bullish divergence arises. Bearish divergence will arise if the CCI makes a lower maximum and the underlying asset makes a higher maximum.

We should say that when there is a strong trend, the divergences may be wrong.

Conclusion

The Commodity Channel Index is a universal technical analysis instrument which is used to detect upcoming trends and identify oversold and overbought positions. The CCI has a great combination analyzing potential and accuracy. Other indicators may be used in order to approve signals send by CCI.

Leave a Reply