Support and resistance levels on IqOption are substantial levels on the asset graph that the price might retrace from. Trading on breakouts and trend reversals is a famous approach of selecting market entries.

Resistance and support lines are the most apparent technical analysis indicator. At least, you have to give them a chance since many investors and traders globally rely on them every day.

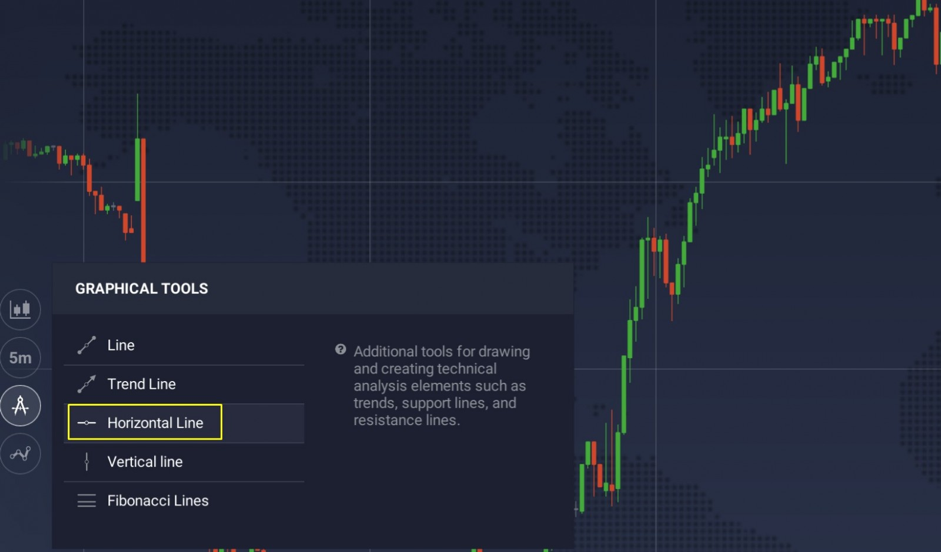

Support and resistance lines on the graph

You can draw these lines on any type of graph: candlestick, bar, area or line. But like with other forms of technical analysis, they are the most visible on bar and candlestick graphs. Support and resistance levels may help traders find out at what point to buy an asset with a decreasing price, and when to sell it.

As you may see, support and resistance levels mirror peaks and troughs on the price graph. These local price extremes are the basis of trading. They mirror the law of the financial market – the concept of supply and demand. Support and resistance levels are generated on the graph as bidders are driven by the price level which the price reached the last time. They don’t want to risk, and start getting rid of their ongoing positions at a safer level.

Traders who apply support and resistance levels have strategies in their trading system both for breakouts of the level and rebounds from the level.

Rebounds

If the price comes closer to the levels from which it bounced back previously, it may rebound again, therefore, generating a price channel.

The picture above demonstrates the price movement in a flat with distinct thresholds. The upper limit of the flat acts as resistance for the market, and the lower limit acts as support. Several traders consider the rebound as an entry opportunity, closing the trade when the price comes to the upper threshold.

Likewise, an entry point for selling is the moment of rebound from the level of resistance at the upper boundary, exiting the deal at the support level. Besides the horizontal levels of support and resistance, there are as well inclined levels. These are known as trend lines.

Trend lines hint at the direction of movements of the price. They are formed with the use of the local highs of the negative trend and lows of the positive trend. Keep in mind that you may as well add horizontal levels on the price graph as a part of the overall strategy.

It is as well likely for an old resistance level to become a new support line (if the price of the asset moves up), and conversely for a negative trend price movement. Retracements in the direction of the trend may be considered as one of the signals. If the retracement is more powerful and the price breaks through the trend support, traders think about using a strategy in accordance with breaking out of the support and resistance levels.

Breakouts

Support and resistance breakouts occasionally give an opportunity to overcome a powerful trend. Keep in mind that this technique is more difficult to apply than the one mentioned before as the trader is required to monitor the market almost continually in order not to miss an entry point. Numerous traders who make use of the breakout do not enter straightaway, but wait for the retracement after the breakout, and only then enter the market.

Fakeout

Breakouts of the support and resistance levels may be real or fake. False breakouts regularly fool traders, because the price broke through the level and have to be on a good wave, but in the end exactly opposite happens – the price moves back behind the level and go in the opposite direction.

In this situation it is best to wait until the following candlestick closes after the break and evaluate the market situation. When the price returns back after the breakout and the candlestick is formed opposite to the breakout, then this is most likely a fakeout.

In case of a true breakout of the trend, a number of traders consider entering with the retracement after the breakout.

Conclusion

Trading on support and resistance levels make use of of the psychology of the masses – market members concentrate on how the price behaved in an identical case previously. They determine the maximum and minimum prices over the ongoing time period (for instance, over the past week), and estimate events which happened throughout this time or which may happen in the near future. If the initial information associated to the asset does not suppose any violations and there are not any events which would influence the asset more than in the past week, it is reasonable to suppose that the price will stay in the same corridor moving forward.

In order to trade applying this approach, you have to learn how to build support and resistance lines and watch the background news for the purpose of avoiding running into a sudden breakout. Keep in mind that any technical analysis instrument cannot be 100% precise, because all of them may give false signals.

Leave a Reply