IqOption Retail Account

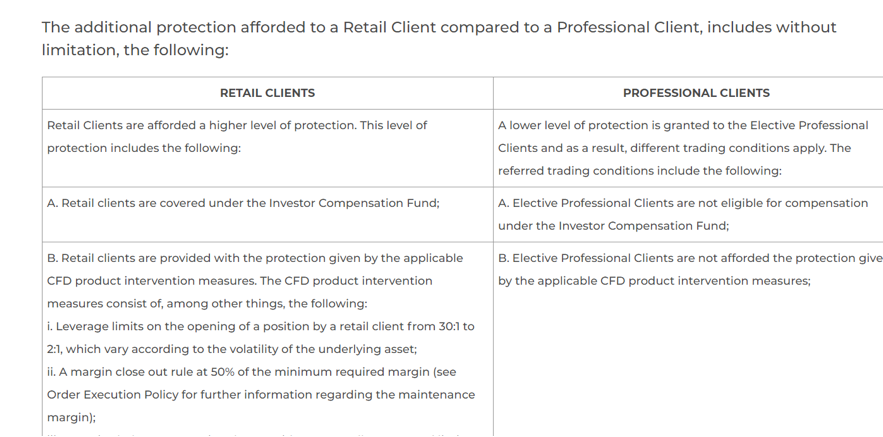

To start with, there are two categories of clients: retail and professional. With a retail account you get a higher level of protection. Moreover, with a retail account you get coverage under the ICF and protection under the applicable CFD product intervention measures. In addition, retail account provides investor protection in relation to the forbiddance of binary options products.

IqOption Professional Account

Professional account has a lower level of protection. Also professional account doesn’t provide coverage under the ICF and it doesn’t provide protection under the applicable CFD product intervention measures. Furthermore, a professional account doesn’t provide investor protection in relation to the forbiddance of binary options products. With a professional account you get access in products with a higher risk profile, at the discretion of the Company.

Main Requirements Ror Professional IqOption Clients

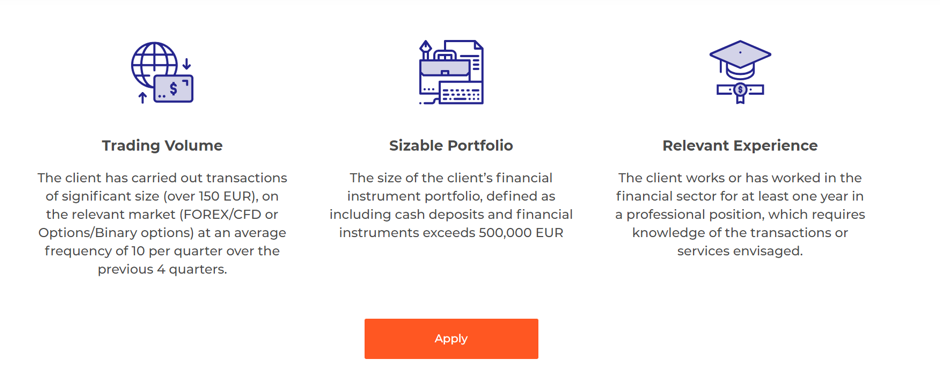

For the purpose of applying for the Professional client, you have to meet any 2 out of 3 following criteria. The first criteria is trading volume, you are supposed to execute transactions of substantial size (more than 150 EUR) on the relevant market (Binary options/CFD/ Forex/Options) at an average frequency of 10 per quarter for the past 4 quarters.

Another criteria is to have a big portfolio, the size of your portfolio, including financial instruments and cash deposits has to be over 500,000 EUR.

The last criteria suppose that you have an appropriate experience in the financial sector for minimum one year, that you worked in a professional position, that requires relevant knowledge.

Request To Change IqOption Categorisation

Professional Clients may request to be classified and concerned as Retail Clients and in this case a higher level of protection will be provided.

Eligible Counterparties may request to be classified and concerned as either Professional or Retail Clients and in this case a higher level of protection will be provided.

Procedure To Change IqOption Categorisation

The Company will carry out the fitness test in order to evaluate if a client may be classified as an elective professional client. To pass the test successfully, the client should meet at least 2 out of 3 criteria mentioned above.

Moreover, the client should state in writing to the Company that they want to be concerned as professional clients, either commonly or regarding a specific investment service or transaction, or kind of transaction or product. The company, in turn, has to provide them with a clear written warning of the protections and investor compensation rights they might lose. Clients have to state in writing, in a separate document from the contract, that they are aware of the outcomes of losing such protections.

Protection Of IqOption Clients

A retail client will be provided with more information and disclosures regarding the Company, its any investments and services, its commissions, costs, fees and charges and protection of customer financial instruments and customer funds.