Some people believe that the next financial crisis is approaching. So what does it mean for traders? For them it means, that many companies which may be found on the IQ Option platform, might lose in price. It worth it, to obtain such a skill on how to trade a decreasing stock, IqOption falling asset in our case. Even when there are no financial crisis, there are good companies, that appear to be in an unfavorable market conditions and they also begin to lose in price.

A majority of traders are aware of the fact that it is better not to catch a falling knife, for example, buying a decreasing stock. People say not to go against the trend and there is a reason for that. If you buy a decreasing stock, you don’t know when the trend change will happen, so there are more chances that you will lose funds during the original decrease rather than you will earn later, when the stock will recover.

In this article, we will talk about 2 helpful tips from Jeff Clark about trading a falling stock. Jeff Clark is an experienced trader, who is also an ex Silicon Valley money manager. Jeff clark is famous because of his trades on the edge of Black Friday and dot-com bubble bang.

According to Jack, you can easily get defeated if you buy a stock that is still losing in price. What you should do instead, is buying a decreasing stock when its price hit the bottom and the trend shift will be anyway. When there is a minimum price of the stock, a trader can open a positive(bullish) position in this certain stock and hold onto it. This is Jeff’s method to identifying the accurate moment to open a positive (bullish) position.

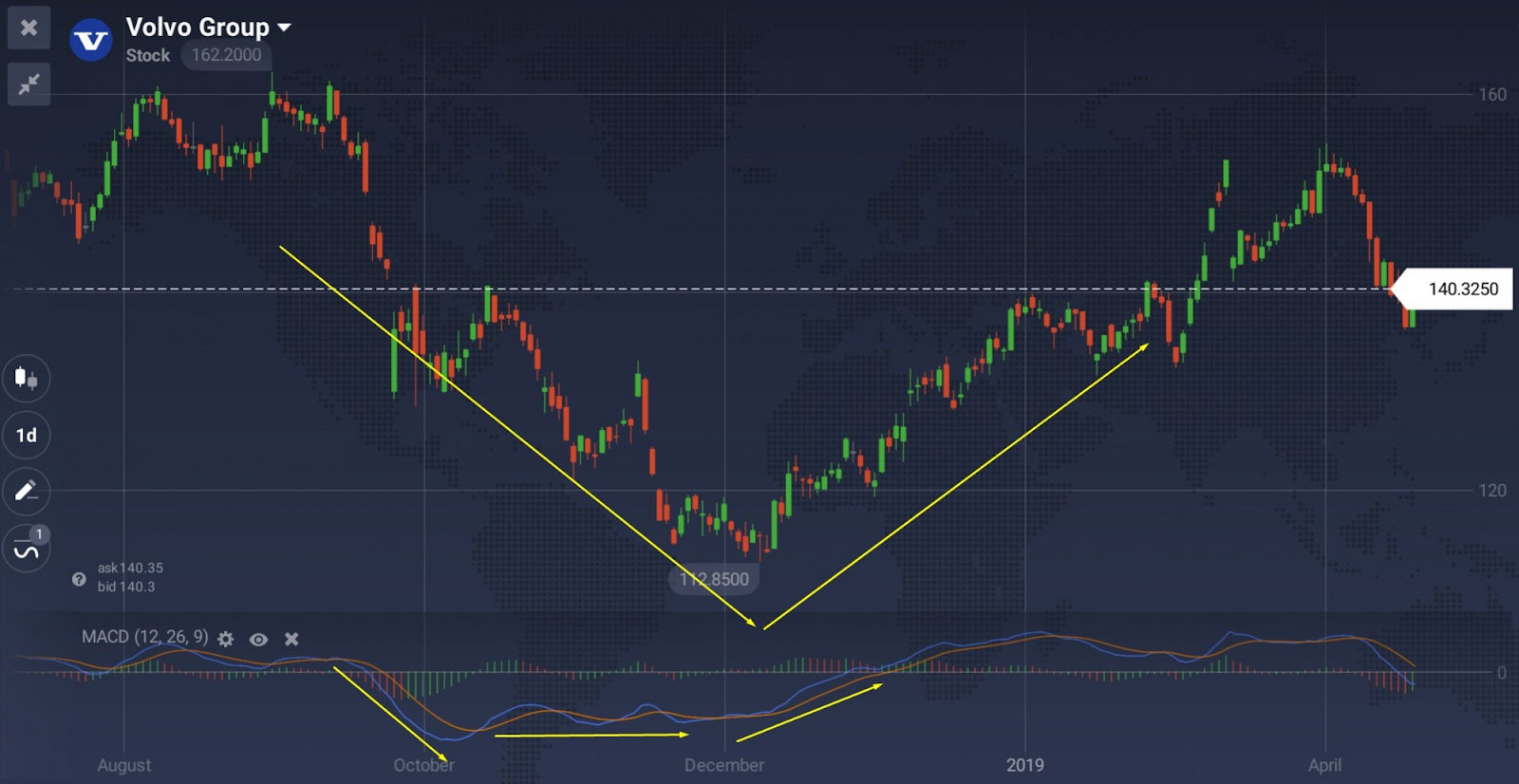

Look at this Volvo graph which is an ideal example of the IqOption falling asset. You may see that from October to December 2018 the company has been experiencing a tough time. The bearish period was probably quite long to bankrupt accounts of those who wanted to invest in the company during the initial positive retracement, because Volvo continued losing for quite long after a breath recovery in the end of October – beginning of November.

Jeff Clark believes that the first rule of buying depreciating stocks is to never buy the first fall. There will always be the second one after the first one. In this specific case, Volvo had 3 drops and consistent retracements before it reversed the negative trend.

According to Jeff’s second rule you may consider BUY opportunities after the second fall, but only if the technical tools approves this idea. In this case you can use MACD, which is one of the main oscillator-type indicators.

It is really easy to understand how it works. When MACD shows new minimums, the negative trend is still powerful and even lower minimums can’t be fully excluded. If the stock is depreciating but MACD is moving up, the positive potential is growing up. Sp this is the situation thay volvo had in the late 2018. After the original price fall, MACD stayed in the negative zone. Then MACD stayed comparatively flat, but negative for a certain period of time. When the indicator began going up , the company started to recover and the price of the stock increased accordingly.

The investor who bought Volvo shares after the first 2 falls, most probably lost his funds. After the 3rd fall, when technical indicators demonstrate positive dynamics, the trader could gain a great company, which had a potential to rise in the following weeks and months at a price which is lower than its intrinsic value.

All of the mentioned above were the Jeff Clark opinion. It can give you helpful information about the trading of the depreciating stock. Nevertheless, you have to keep in mind that the market is confusing sometimes and it may be difficult to forecast what will happen. Consequently, this strategy doesn’t have a warranty to have positive outcomes all the time.

Leave a Reply