What is IqOption CCI + MA?

Trend is generally defined as a position of general position of quotation in relation to average values. That is the reason why MA indicator is totally irreplaceable for determination of the current trend. Nevertheless, the moving average does not display the ideal point to start the deal towards the direction of a trend. Hence, a lot of traders apply the CCI oscillator to resolve this issue.

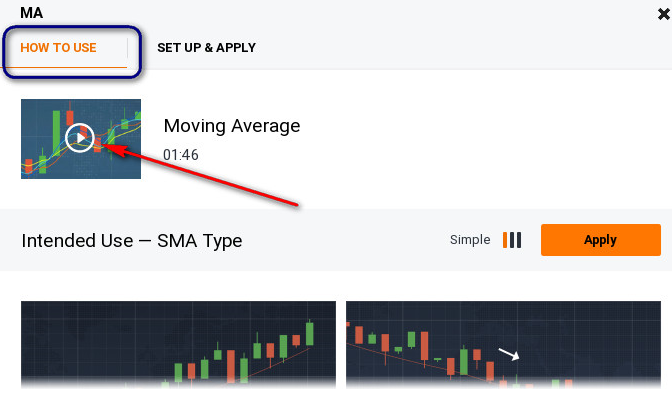

The video, situated in MA settings window of the IQ Option platform, briefly explains the types of moving averages as well as the applications.

The general steps of utilizing various moving averages types with other indicators, are also available with distinct explanations for standard and up to advanced levels.

In order to determine a trend via the moving average, you are required to enter based on the crossing the CCI indicator curve at +100 level.

Settings of the Indicator on iq option

The setting up procedure of any trading system generally involves the following 3 factors:

1. Timeframe of the work;

2. Settings of the indicator (type of the curve to be applied for this steps, period

of the indicator);

3. Time required to hold the position (expiration of option);

A lot of problems appear with regards to the selection of the type of moving average. Basic moving average is considered to cause many false signals during flat sections. In addition, other types tend to diverge when weight coefficients are present, resulting in increase of latest data importance. In case of exponential moving average, the nearest average values influence has an exponential growth.

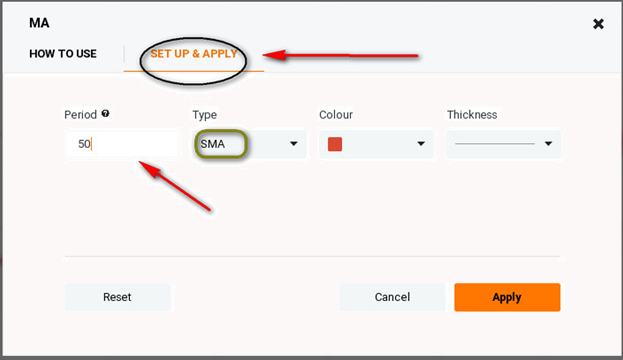

Natural selection involves the application of investor periods of moving average equal to 50, 100 and 200. Those periods are utilized by analysts in their reports and also included in the portfolio managers of trading various platforms. The following example, shows a simple moving average with a set period of 50:

SMA settings. Period = 50

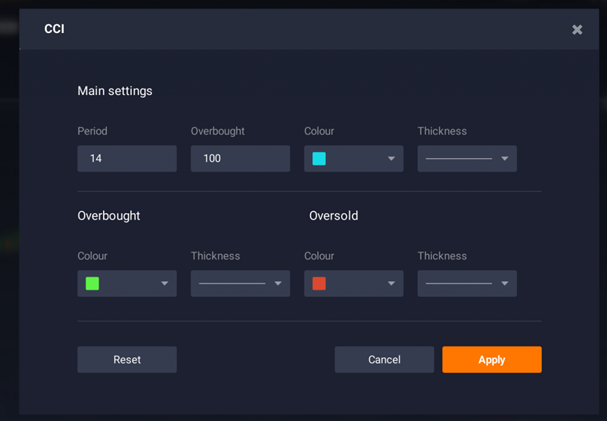

Indicator settings are used for trend identification – CCI period of 14 and SMA period of 50:

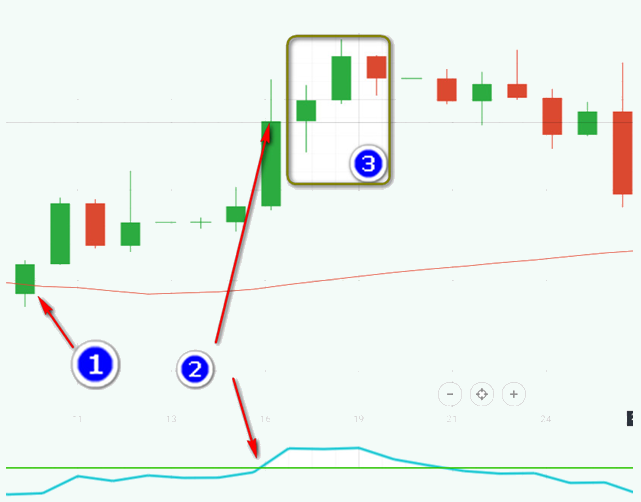

CCI (14) and MA (50) plotted together on a trading chart

Upward trend

The upward trend’s inception signal is provided by a candlestick, which is crossed and then closed once above the line of SMA. The readings of CCI should be higher than 100. The attached below figure displays the upward trend inception features: price crosses the moving average, while quotations close above the line (1).

Wait till the indicator of CCI is equal or more than 100 (2). By using this method traders are able to make the options purchase with 3-4 candles ahead.

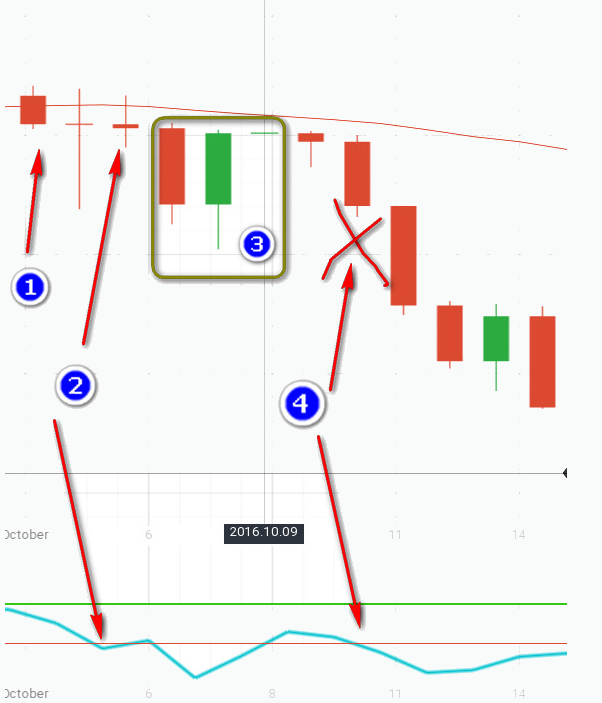

Downtrend

In case it is decided to purchase a Put option, the best method is to wait for quotations congruence once they are crossing the line of SMA in a top-down pattern. Meantime the closing candlestick price should be below that line and CCI should experience a decrease with values below 100, as displayed in the figure provided below. The intersection SMA and quotations in that diagram appears earlier than supposed to, hence the decision to not enter is taken.

In this situation the best steps is to wait until CCI matches the proper condition, check it in point #2, and the wait for three timeframes (3).

In case of subsequent purchases of turbo options as well as binary options, the following steps are to be done on that trend. One intersection represents one trend; hereby, regardless of the fact that point 4 of the case shown in the abovementioned figure displays the problem of finding quotes that are below SMA as well as the CCI signal that has newly appeared below 100 value, which was previously rising above that particular level, it is not recommended to enter that position.

Periods of Indicator

Some traders ask, whether it is possible to perform scaling of this trading method using diversified timeframes. The standard method requires CCI + MA methods to be applied for daily candlesticks. Taking in consideration the smaller timeframes, it is possible to change the moving average period. Likewise, in case of 4-hour candlesticks the moving average is 100, for 1-hour candlesticks and below the moving average is 200, while the indicator of CCI remains the same, i.e. a 14-period. In case if you decide to do some experiments, then it is advised not to use the values of that period higher than 24.

Traders who are still new and not experienced enough, try to get the ideal values of indicators and systems by applying brute force or by having an extensive literature search. In fact, investment institutions also assign similar types of tasks to mathematicians and the designers of new indicators. The perfect solution has not been confirmed yet. However, there is already a very firm understanding about the cyclical changes that exist in the market. However, their parameters keep changing all the time. The mission to reflect those changes in a precise manner still remains impossible, because it requires the connection of their functional dependency to a certain thing, which will then allow to have a more precise prediction. In order to achieve the best analysis possible, it is recommended to apply the period values mentioned in the books by trading classicists, because usually they continuously deal with the market cycles.

Leave a Reply