What is Chande Forecast Oscillator (CFO)?

Chande Forecast Oscillator (CFO) is an oscillator-type indicator that can help you evaluate the future price of the asset. If you ever wonder whether the price of your favorite asset will go up or down, then CFO may help you with this.

This indicator can be helpful for short-term CFD trading because it only shows the expected direction of the price change. Moreover it is not difficult to set up and start using it. In this article you will learn more about it and then you can try the indicator in trading!

How CFO works?

Many technical analysis tools do not give information on the future price of the asset but Chande Forecast Oscillator was developed with only one purpose: to predict if the asset price will increase or decrease. You may ask: how it is possible that most indicators do not give information on the future asset price. Most of the indicators can indirectly show the probability of a trend reversal or inform you of an upcoming retracement. Nevertheless, barely some of them have been developed in order to directly forecast the future price of the asset. CFO was developed specifically for this purpose.

The CFO takes the difference between all recent wins and all recent losses and divides it by the price of all price movement. According to these calculations, the indicator will be higher or lower than the zero line. If the readings are higher than the zero line and going up, the asset price is believed to move up (based on the indicator). Vice versa, if the readings are lower than the zero line and continue moving down, the asset price is considered to move down (based on the indicator). According to this presumption traders choose when to open the trade and in which direction.

How to use CFO in trading?

There are some ways how you the Chande Forecast Oscillator indicator can be used. You can use just the CFO or you can use it as an addition to a more complicated trading system (with the use of 1–2 indicators). When you trade using only CFO, traders think about opening BUY and SELL positions relying on the indicators’ readings.

Moreover the CFO may approve signals which are sent by other indicators. If the indicator crosses above the zero line, a bullish confirmation is received. If the indicator goes below the zero line, a bearish confirmation is received.

There are 2 rules which you have to follow if you trade with Chande Forecast Oscillator on Iqoption:

1. CFO just as any other indicator may give false results, so signals may not be correct all of the time.

2. If use CFO, also use other indicators in order to double check the information which was sent by the CFO. Volatility, volume and trend-following indicators can be used together with the CFO in order to achieve a better performance.

It is important what time frames you choose because they can have a big effect on the signals which the indicator will send. Check that you do not open long-term trade after you received short-term signals and do not open short-term trade after you received long-term signals. Professional traders do not suggest that you take the readings for granted, better learn how to identify patterns which the indicator gives and use them in your trading.

How to set up?

When you work with IQ option, it is easy to set up the CFO and any other indicators.

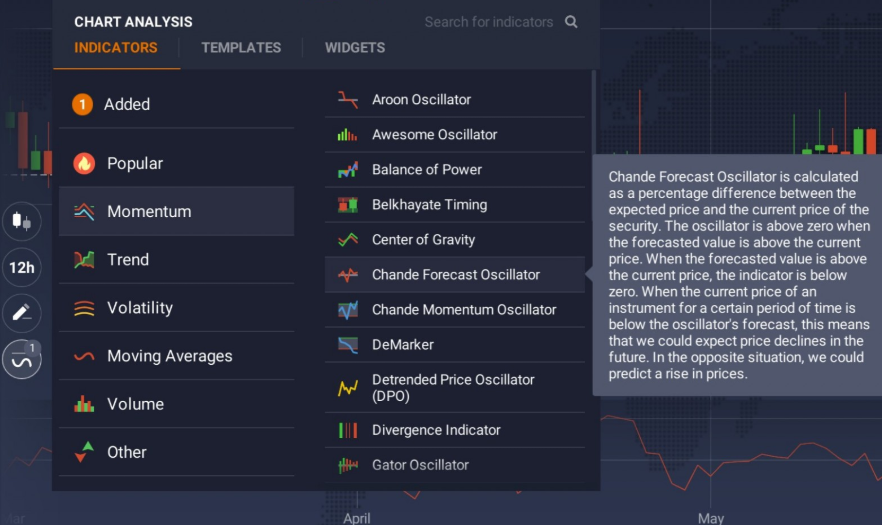

- Click on the ‘Indicators’ button in the bottom left corner of the screen when you are in the trade room.

- Go to the ‘Momentum’ tab and pick Chande Forecast Oscillator from the list of indicators,

- Don’t change the settings and click the ‘Apply’ button.

Now you can use the indicator!

Now, that you know how to set up and use CFO in trading, you can go to the platform and try it yourself. It may help you improve your trading performance.

Leave a Reply